Back

7 Sep 2020

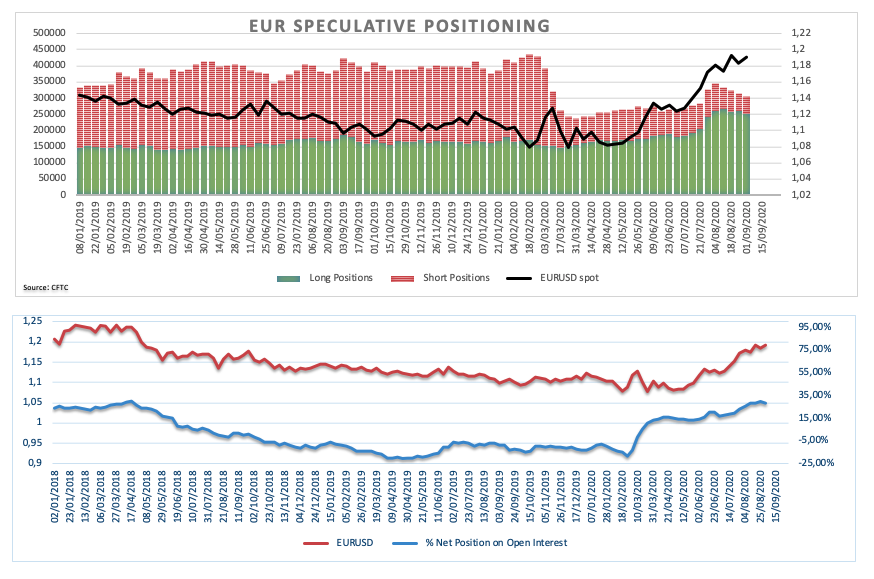

CFTC Positioning Report: Net longs in EUR receded to multi-week lows

These are the main highlights of the CFTC Positioning Report for the week ended on September 1st:

- Speculators reduced their net positions in the single currency to the lowest level in the last four weeks. The strong rally since July prompted investors to cash out part of those gains, while ECB-speak also motivated sellers to step in.

- On the opposite side, net shorts in the dollar went down to 4-week lows in response to the correction seen in the euro plus some encouraging data from the US fundamentals.

- In the safe haven universe, the Japanese yen reached multi-week highs following a pick-up in the sentiment towards the risk aversion; CHF, in the meantime, eased to 5-week lows.

- In the commodities galaxy, net longs in crude oil dropped to the lowest level since April 7, in response to the re-emergence of demand-side concerns.