Back

16 Mar 2020

CFTC Positioning Report: EUR net shorts trimmed dramatically

These are the main highlights of the CFTC Positioning Report for the week ended on March 10:

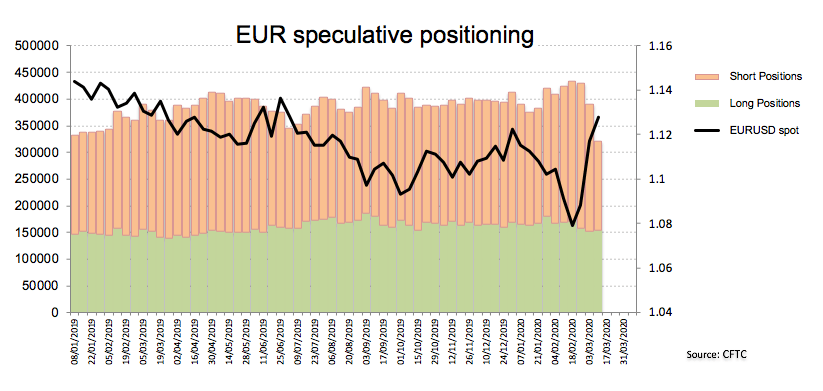

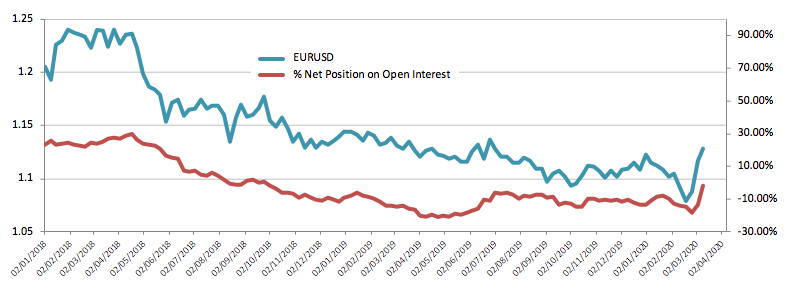

- Speculators scaled back their gross shorts in EUR by more than 120K contracts in the week ended on March 10th, taking the net shorts to the lowest level since early October 2018. The extreme oversold levels observed in previous weeks plus market chatter regarding the Fed move on rates were behind the noticeable correction.

- On the opposite side, USD net longs fell to levels last seen in late October 2019 around 12.4K contracts, with gross longs shrinking for the fourth consecutive week at the same time. The surprising Fed’s move on the FFTR and the prospects of extra easing played against further gains in the buck.

- JPY returned to the positive territory for the first time since October 8th 2019, always supported by demand for the safe haven universe amidst increasing COVID-19 concerns.