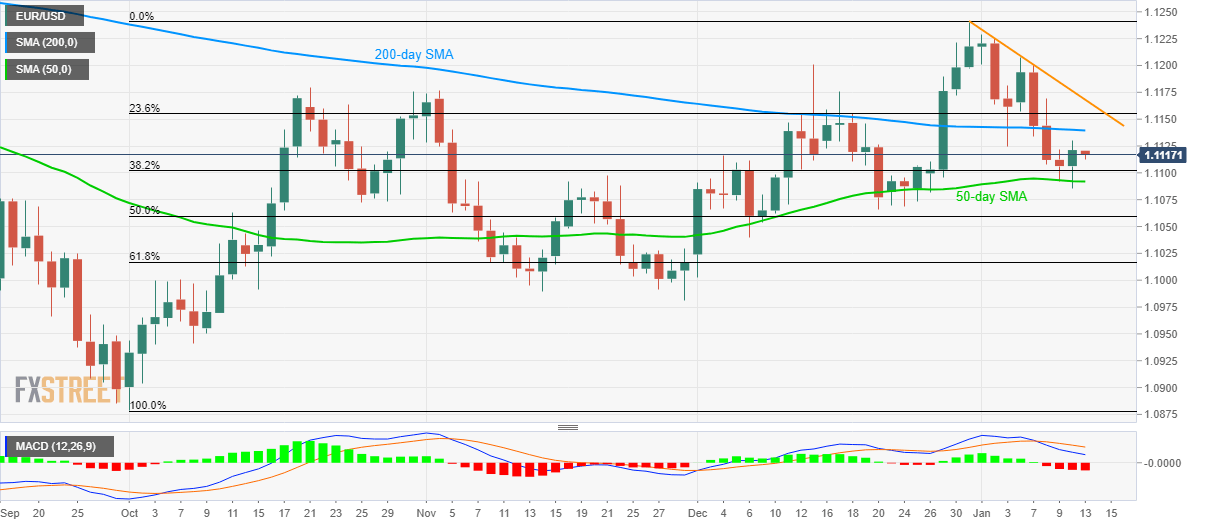

EUR/USD Technical Analysis: Buyers struggle to hold onto recovery from 50-day SMA

- EUR/USD fails to extend the bounces off short-term key SMA.

- 200-day SMA, two-week-old falling resistance line keep upside limited.

- 50% Fibonacci retracement can please sellers during fresh declines.

Having bounced off 50-day SMA on Friday, EUR/USD pulls back to 1.1117 during the Asian session on Monday. With this, sellers concentrate on the bearish MACD to aim for a downside break below the mentioned SMA level of 1.1090 for a fresh rule.

In doing so, 50% Fibonacci retracement of pair’s run-up from the early-October to late-December 2019, around 1.1060 will be their following target.

Should there be additional south-run past-1.1060, 1.1030, 61.8% Fibonacci retracement mark of 1.1017 and November month low of 1.0980 will return to the charts.

On the flip side, 200-day SMA level of 1.1140, 23.6% Fibonacci retracement around 1.1155 and a descending trend line since December 31, at 1.1170 now, will question pair’s near-term upside.

Given the pair’s sustained rise past-1.1170, 1.1200 and 1.1240 will gain the Bull’s attention.

EUR/USD daily chart

Trend: Pull expected